Germany is not sliding toward confrontation by accident — it is actively preparing for it. Not defensively, not diplomatically, but operationally. This preparation hides in plain sight: under the banner of climate transitions, infrastructure renewal, labor policy, and defense realignment. Behind these technocratic facades, however, lies a darker logic — one that views war not as a last resort, but as a lever of economic and social reset.

Germany is in economic decline. The once-envied economic engine of Europe is sputtering: deindustrialization, demographic collapse, energy dependency, and a toxic regulatory environment have conspired to hollow out the country’s real economy. The pension system, for instance, is mathematically unsustainable. Millions of retirees are drawing from a system funded by a shrinking base of contributors. Instead of structural reform, the system is silently leaning toward wartime attrition logic: fewer elderly survivors mean fewer obligations. Infrastructure spending is similarly misleading. Billions are flowing into rail, bridges, roads, and energy corridors that—upon closer inspection—serve both civilian and military purposes. These aren’t just projects for economic growth; they are strategic logistics assets, prepped for deployment and rapid mobilization.

Migration policy offers another lens. Angela Merkel’s famous “Wir schaffen das” might not have been naïve optimism, but the beginning of a long-term demographic strategy. Refugees are no longer viewed as citizens-in-the-making, but as disposable labor units—able to maintain domestic economic functions when German nationals are conscripted or mobilized. These populations are held in a kind of economic limbo: tolerated, under-integrated, and structurally useful for a wartime labor economy.

The reintroduction of conscription is quietly making its way back into public discourse. Already being tested in countries like Poland and the Nordic states, the draft is no longer a taboo subject. Alongside this, military spending is being ramped up, recruitment structures are being restored, and the Bundeswehr is once again becoming a normalized element of national pride among younger political elites. Financially, we are witnessing a shift towards what could be called silent capital mobilization. This doesn’t just mean inflation or central bank intervention—it means increasing fiscal control, soft forms of capital restriction, and a pivot to government-directed investments that align with future military logistics.

This isn’t new. There are historic precedents that match this trajectory. In World War I, Britain imposed strict capital controls, nationalized industries, and coerced businesses into alignment with the war effort. The United States, during WWII, used mechanisms like the Trading with the Enemy Act to control private property and capital flows while presenting a façade of economic normalcy. Business autonomy was an illusion—property rights existed only as long as they served national priorities. Germany is walking the same path, this time under the guise of sustainability, climate resilience, and geopolitical solidarity.

War, paradoxically, is often profitable for states on the verge of collapse. It allows the reallocation of labor, the destruction of unpayable social liabilities, the consolidation of state power, and the creation of moral justification for radical policy shifts. It wipes out the burdens of old systems and replaces them with a centralized command structure. For Germany—and increasingly for the European Union—war is not the price of failure. It is the method of escape.

This direction also matches a wider global narrative. Over the next decade, the global economy must invest nearly 3.5% of GDP per year—about 4.2 trillion US dollars—to future-proof social, transport, energy, and digital infrastructure. Much of this investment is not about innovation or growth but about resilience and control. Supply chains are being restructured not for efficiency but for security. Data centers are multiplying, not because of consumer demand, but due to artificial intelligence arms races. Even urban planning is starting to resemble logistics architecture. The US must spend over 1 trillion dollars on its roads and logistics. China is aiming for 1.5 trillion. India needs another trillion. France, Germany, the UK, and Spain together must invest 500 billion. These are not investments in peace—they are hedges against collapse. In Europe, the idea of “reshoring” or “friendshoring” means building supply lines that can survive geopolitical shocks. The rhetoric is about independence. The practice is about militarization.

Germany fits neatly into this playbook. Its public discourse is filled with talk of climate transitions and economic competitiveness. But the actions—new rail lines, increased defense budgets, the militarization of digital infrastructure—suggest something else entirely. In this light, migration flows are not humanitarian gestures. They are contingency planning. When German men are sent east, someone must drive the trucks, process the food, and keep the lights on. That someone will not be drafted Germans. It will be a new class of economic resident: tolerated but not embraced, necessary but not empowered.

This is not conspiracy theory. This is the slow, grinding reality of how states prepare for war without telling their populations. If the current trajectory holds, the implications for citizens, investors, and business owners are dramatic.

Private capital is not safe in a wartime economy. All wealth becomes subordinate to state survival. Forced war bonds may be reintroduced. Exit taxes on outbound capital can appear overnight. Gold ownership can be restricted or outright banned, as happened under Roosevelt in 1933. Real estate can be seized for military use or refugee housing. If your wealth is locked inside German banks, pensions, or land, it is exposed to expropriation by policy, not by law.

Entrepreneurs are equally vulnerable. Your company might remain nominally yours, but your supply chains could be redirected, your profit margins capped, your intellectual property classified as a strategic asset. In short, the sovereignty of private enterprise evaporates once the state declares an emergency—formally or not.

Citizens will lose autonomy as well. The military draft may expand to include not only young men but also women, specialists, medics, and technocrats. Travel rights may be suspended. Surveillance will intensify. Dual citizens could be targeted for special taxation or mobility restrictions. Democracy may still be spoken of—but its mechanisms will be frozen.

What, then, can be done? The answer begins with internationalizing your assets. Moving part of your capital outside of the Eurozone—into foreign currencies, offshore gold, or digital assets—can be a lifeline. Acquiring a second residency or passport is no longer a luxury. It is a survival plan. Countries like Portugal, Panama, Paraguay, or the UAE offer flexible options. Business owners should decentralize their operations. Even a partial relocation of personnel, suppliers, or offices can offer strategic depth. Families should think in terms of redundancy—not just in food and energy, but in education, healthcare, and financial systems.

Most importantly, reliance on state-run systems—pensions, health insurance, energy grids—should be reduced. These services will be reoriented to support war logistics. Your long-term benefits will be treated as fiscal liabilities, not promises.

Germany will not declare war. It will simply begin acting as if war already exists. The citizen who adapts, protects, and diversifies now may survive what’s coming. The one who waits for confirmation will be too late.

Britain’s Fiscal History as a Warning

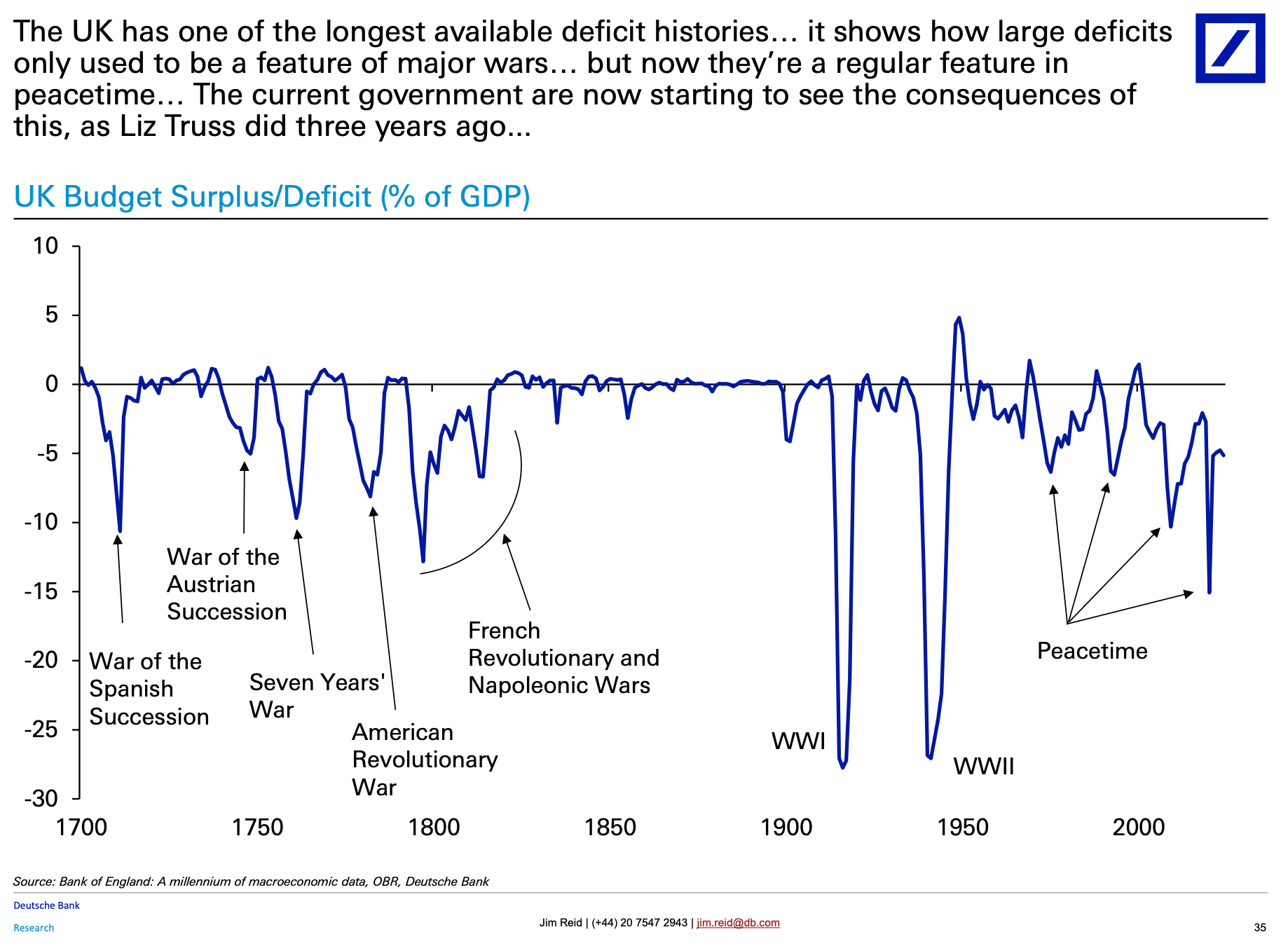

The United Kingdom offers a sobering precedent for what we are now witnessing in Germany. Historical budget data show that Britain’s deepest deficits occurred almost exclusively during major wars – the War of the Spanish Succession, the Napoleonic Wars, the World Wars. Crucially, those wartime deficits were followed by rapid debt reduction, driven by post-war growth, inflation, and disciplined fiscal consolidation.

In contrast, today’s deficits in Britain – and increasingly across Europe – are peacetime phenomena. They lack both the political legitimacy of wartime borrowing and the natural reset mechanisms of post-conflict reconstruction. The result is a slower, more fragile downward trajectory, where debt burdens accumulate without relief.

This is precisely why war begins to look like an economic solution: it legitimises deficit spending, accelerates the destruction of unsustainable liabilities, and creates the conditions for rapid restructuring once the conflict subsides. Germany’s militarisation therefore cannot be understood in isolation. It fits into a broader historical pattern: when peacetime deficits become permanent and politically untenable, war is reframed as both necessity and cure.

France – From War Deficits to Structural Imbalance

The French case underlines the same historical pattern we observed in Britain – but with an even sharper warning. For almost two centuries, France’s deepest fiscal deficits coincided with wars: the Franco-Prussian War, World War I, and World War II. In each case, extraordinary wartime borrowing was followed by a clear reset mechanism – reconstruction, inflation, or political restructuring – that allowed deficits to be reduced.

Since 1974, however, France has not recorded a single budget surplus. The extraordinary has become permanent. Deficits are no longer linked to existential wars but to the day-to-day functioning of the state. What was once exceptional wartime finance has turned into chronic fiscal imbalance.

This shift is dangerous because it removes the “reset button” that wars once provided. Without either genuine growth or the destructive-cleansing cycle of conflict, deficits accumulate endlessly. For policymakers, this makes war appear—paradoxically—not as a calamity but as the only remaining tool to compress obligations and restart the fiscal cycle.

Key points:

1. War as Economic Accelerator

The inconvenient truth: war is profitable for states in collapse. It creates:

A forced labor reallocation.

A destruction of liabilities (think pensions, social programs, non-performing industries).

A moral license for unpopular policies.

An excuse for centralized governance that bypasses democratic friction.

While it devastates populations, it rejuvenates systems of control. For Germany — and increasingly the EU — war is not the consequence of failure, but the method of reboot.

2. Migration as Wartime Labor Strategy

Angela Merkel’s famous “Wir schaffen das” was not naïve optimism. In retrospect, it may have been the beginning of Germany’s wartime demographic policy.

The logic: when German men are sent to the Eastern front, who will operate the economy?

Industry must continue.

Infrastructure must be maintained.

Agriculture must feed both civilians and soldiers.

This is where refugees, asylum seekers, and low-wage migrants come in. Not as participants in the social contract, but as non-voting, expendable, scalable labor.

No integration necessary.

No political representation.

No pensions or long-term obligations.

This is not conspiracy. It is policy — just not publicized.

3. The Coming Firestorm: What Citizens, Investors, and Business Owners Must Understand

This is not theoretical. If Germany continues down this path — and indicators suggest it will — then the consequences for private actors will be enormous.

Capital is not safe

In wartime economies, all private wealth is considered subordinate to state survival:

Forced war bonds may return.

Exit taxes on outbound capital can be implemented overnight.

Gold prohibitions and confiscations are historic precedents (see U.S. Executive Order 6102, 1933).

Real estate seizures for military use or mass housing are not unthinkable.

If your wealth is in German banks, land, or pensions — you are at risk.

Entrepreneurs are not protected

You may own your company, but in a militarized economy:

Your supply chains will be rerouted.

Your hiring practices may be regulated.

Your profits may be capped or taxed away for “national priorities.”

Your IP may be deemed “strategic” and co-opted by defense authorities.

Citizens will lose sovereignty

Military drafts will expand to include not only young men but possibly women, technicians, medics, and logistics professionals.

Travel freedoms may be curtailed, especially for dual citizens.

Digital surveillance will expand under cybersecurity pretexts.

4. Strategic Exits: What You Can Do Now

Internationalize Your Assets

Move part of your capital outside the Eurozone. Consider:

Foreign bank accounts (in USD or CHF)

Gold stored offshore

Digital assets (carefully selected and stored)

Acquire Second Residency or Citizenship

Countries like Portugal, Panama, Paraguay, or the UAE offer fast-track options. Dual nationality can be a lifeline when borders close.

De-risk Your Business Operations

If your business depends on German subsidies, regulations, or local labor, diversify. Move at least part of your operations abroad — even if just for redundancy.

Build Network Redundancy

Supply chains, professional alliances, even education for your children — build optionality. Assume Germany becomes ungovernable or hostile.

Reduce Exposure to State-Controlled Systems

Rely less on state health insurance, public pensions, or state universities. These systems will be redirected to war efforts — and you may become a “source of funding.”

Final Thought: Silence Is Consent

Germany’s silent march toward a militarized economy is not a paranoid fantasy. It is the aggregation of hundreds of small steps — each reasonable on its own, each devastating in total.

The state will not announce war. It will simply act as if it is already in one.

And unless private citizens, business owners, and capital holders act now, they will wake up one day to find their assets mobilized, their freedoms restricted, and their futures conscripted.

P.S.

The Blueprint of War: Göring on Mass Control

While still imprisoned during the Nuremberg Trials, Hermann Göring gave an interview to the psychologist Gustav Gilbert.

Göring said: “Of course the people don’t want war. Why should some simple farmer risk his life in a war, when the best he can get out of it is to return to his farm uninjured? No one wants war - neither in Russia, nor in England, nor in America, nor in Germany. That is obvious.

But after all, it is the leaders of the country who determine the policy, and it is always a simple matter to drag the people along, whether it is a democracy, or a Communist dictatorship, or a Parliament, or a Fascist dictatorship.”

Gilbert replied: “There is one difference in a democracy - the people can express their opinion through their elected representatives.”

Göring answered: “Oh, that is all well and good, but whether the people have a voice or not, they can always be brought to heel. It is simple. You just tell them they are being attacked, and denounce the pacifists for lack of patriotism and exposing the country to danger. That works the same in any country.”

Source: April 18, 1946, quoted from Gilbert’s book Nuremberg Diary

Source (page 270): https://perma.cc/JSC9-42J9