(Last update Nov. 2025)

Read Part 1 for the story’s beginning: https://breakingnasdaq.beehiiv.com/p/wtf-happened-with-germany

Explore Part 3 to continue the story with the latest news and updates: https://breakingnasdaq.beehiiv.com/p/wtf-happened-with-germany-part-3

Germany's Economic Decline Since 2019

Germany, Europe’s economic powerhouse, has lost ~20% of its industrial growth potential since 2019 due to:

Overreliance on Russian energy and phasing out nuclear power.

Underinvestment in infrastructure and modernization.

Heavy export dependence and underestimating China’s manufacturing rise.

Bureaucratic inefficiencies, an aging population, and migration-related social strains.

Why It Matters: Germany’s struggles ripple across Europe, impacting regions like Russia and Ukraine, and risk Eurozone stagnation.

Evidence of Decline

Industry: Major firms like Deutsche Bahn and ZF cut jobs; SMEs downsize.

Energy: Soaring costs despite $1T in renewables, with heavy import reliance.

Social Unrest: Over 40% of Germans prioritize financial struggles; trust in leadership erodes.

Global Context Germany lags behind economies like the U.S. (+11% growth since 2019). Potential U.S. tariffs under a Trump administration add pressure.

Defense Sector Uptick Defense production is growing, contrasting with broader industrial decline.

Outlook Rooted in decades-old policy missteps, Germany’s economic and social challenges threaten its European leadership. Rising far-right extremism, including AfD, underscores the need for urgent, inclusive reforms.

“Green transition” they used to call it in Germany

Germany Loses Its Safe Haven Status: A comparison of German and Swiss bond yields suggests the dramatic extent to which Germany has suffered a loss of both its safe haven status and its prestige, as its ability to confront its fiscal deterioration and that of its neighbors has declined.

The universe of safe havens is shrinking, with Germany losing that status this year. The two charts above illustrate what’s going on. The left chart shows the 10-year government bond yield for Germany (blue line) and the 10y20y forward yield (red line) that I’ve backed out from 20- and 30-year bond yields. This 10y20y forward yield is what markets price for the 10-year yield in 20 years’ time. The right chart shows the same for Switzerland. The difference between the two is striking. A true safe haven like Switzerland is seeing yields fall sharply across the yield curve, even at the very long end. That’s no longer true for Germany, where the 10y20y forward yield is up very sharply this year, at a time of elevated global uncertainty that - in the past - would have seen German yields fall. The loss of safe haven status for Germany has a negative externality for the world. It means there’s one less place to hide when global uncertainty rises, which may explain why gold has seen such a massive rally this year. After all, there’s only so much hiding you can do in tiny Switzerland.

Source: Robin J Brooks

The United Kingdom offers a sobering precedent for what we are now witnessing in Germany. Historical budget data show that Britain’s deepest deficits occurred almost exclusively during major wars – the War of the Spanish Succession, the Napoleonic Wars, the World Wars. Crucially, those wartime deficits were followed by rapid debt reduction, driven by post-war growth, inflation, and disciplined fiscal consolidation.

In contrast, today’s deficits in Britain – and increasingly across Europe – are peacetime phenomena. They lack both the political legitimacy of wartime borrowing and the natural reset mechanisms of post-conflict reconstruction. The result is a slower, more fragile downward trajectory, where debt burdens accumulate without relief.

This is precisely why war begins to look like an economic solution: it legitimises deficit spending, accelerates the destruction of unsustainable liabilities, and creates the conditions for rapid restructuring once the conflict subsides. Germany’s militarisation therefore cannot be understood in isolation. It fits into a broader historical pattern: when peacetime deficits become permanent and politically untenable, war is reframed as both necessity and cure.

The French case underlines the same historical pattern we observed in Britain – but with an even sharper warning. For almost two centuries, France’s deepest fiscal deficits coincided with wars: the Franco-Prussian War, World War I, and World War II. In each case, extraordinary wartime borrowing was followed by a clear reset mechanism – reconstruction, inflation, or political restructuring – that allowed deficits to be reduced.

Since 1974, however, France has not recorded a single budget surplus. The extraordinary has become permanent. Deficits are no longer linked to existential wars but to the day-to-day functioning of the state. What was once exceptional wartime finance has turned into chronic fiscal imbalance.

This shift is dangerous because it removes the “reset button” that wars once provided. Without either genuine growth or the destructive-cleansing cycle of conflict, deficits accumulate endlessly. For policymakers, this makes war appear—paradoxically—not as a calamity but as the only remaining tool to compress obligations and restart the fiscal cycle.

Germany’s Constancy Trap – How a Nation Castrates Itself in the Name of Stability

It’s no coincidence that in Germany, even emigration requires a government form. We are the country of insurance policies, certificates, and the sanctified Thermomix. But beneath that polished surface: exhaustion, quiet frustration, a collective paralysis. Welcome to the Constancy Trap – Germany’s national illness, dressed up as rationality.

In short, Europe’s sovereign debt crisis is reaching a crossroads. Bond markets are no longer a distant abstraction – they are now visible constraints on policy. As yields climb and ratings wobble, governments face a choice: keep borrowing in open markets at ever-higher cost, or turn to domestic savers. The latter path can be framed as patriotic – “buying Bunds” or “funding defense” – but it carries a heavy historical risk. War bonds, silent rearmament bonds, Cyprus bail-ins and Argentine corralitos all show that promises of national unity can quickly give way to involuntary sacrifices. Analysts like IMF’s Gopinath and Era Dabla-Norris warn that we are in a “fragile” fiscal moment . If crisis rhetoric ramps up, European governments might well pivot to the “people’s purse”.

Citizens should heed these warnings. History teaches that once a government begins even limited tapping of private savings, a little coercion can turn into a lot. For now it’s a political and rhetorical gamble, but not an impossible one. Europeans would do well to remember the past: the next “loan” could come with terms the public never imagined.

“They need war because they are in a sovereign debt crisis, and pensions, banks, and bonds are in deep trouble.”

Martin Armstrong, the legendary financial and geopolitical cycle analyst renowned for his “Socrates” predictive computer program, has delivered a dire forecast for the world’s economic and political future beginning in 2025. According to Armstrong, the coming years will witness a cascade of depressions, sovereign defaults, debt crises, and large-scale wars that will reshape global power dynamics and economies alike.

Providers of private bunkers report a surge in demand in Germany. The manufacturer BSSD Defence recorded a 50% rise in inquiries since January. Landlords are also inquiring about shelters for their tenants.

According to company boss Mario Piejde, more than half of the inquiries come from companies and landlords. "Companies are calling us because they want bunkers on their premises for their employees." The German Shelter Center (DSZ) in Munich also confirmed a sharp increase in inquiries for small bunkers. "Especially after the recent events in Poland, we have seen an increased demand for consultation appointments."

According to the DSZ, there are various options for building a private bunker: The cheapest is to construct the shelter in the basement of a house. Building a bunker in the garden is also possible in most federal states with a building permit.

Sources:

The two pieces of news somehow fit together and illustrate the absurdity of German politics:

Sources:

In Germany, the short-lived rally at the start of the year has already fizzled out. The country is losing ground on the global stage: German stocks now make up just 2.1% of global market capitalization, down from 2.4% only three months ago.

The German auto industry is expected to eliminate nearly 100,000 jobs by 2030. Carmakers and their suppliers are struggling w/waning demand, high labor, energy costs and intensifying competition from Chinese manufacturers. Overall, Germany’s auto sector has lost roughly 55,000 jobs over the past 2 years. Tens of thousands of additional positions are set to disappear by 2030, in an industry that employs more than 700,000 people.

Lufthansa to cut thousands of jobs in pursuit of efficiency - the airline group intends to reduce its administrative staff by 20%. A total of 15,000 employees work in administration, and 3,000 jobs are to be cut.

Sources: Handelsblatt, Reuters

Bavaria’s fifth-largest city, Ingolstadt, is gripped by a brutal financial nightmare. According to the latest calculations, the municipality is short by a staggering 60 to 80 million euros next year. Until now, city hall fools had been banking on just a 30-million-euro deficit. Kern declared that “Ingolstadt won’t be able to slap together a balanced budget for 2026.” Now, they’re forced to huddle with the legal oversight from the Upper Bavaria government to hash out savage cuts and desperate loans. No concrete schemes yet, but the clock is ticking.

This budget horror show will unleash “brutal consequences,” the mayor snarled. Every single expense and investment is under the microscope for ruthless scrutiny. Slashing voluntary services is on the table, and that means gutting fun stuff like pools, cultural handouts, or subsidies for clubs. Even pricey building boondoggles, like school upgrades or the long-overdue theater facelift, are hanging by a thread.

On top of that, fees and taxes could skyrocket for residents, like jacking up property taxes on homes. The city council has been wrangling over cuts for months already. With these fresh disasters piling on, the austerity vise is tightening even more viciously. “This is a historically unprecedented nightmare for us in Ingolstadt,” Kern growled.

The financial inferno has been smoldering for ages. While costs for construction fiascos, staff bloat, and social handouts have exploded in recent years, revenues from business taxes have plunged off a cliff. “It’s basically halved compared to the glory days,” Ingolstadt’s mayor spat. This year, the city is pathetically expecting only 55 million euros from business taxes. In peak times, it raked in 200 million.

The root of this evil? The auto industry’s epic meltdown. Audi, with its headquarters in Ingolstadt, is the city’s biggest jobs machine. The factory, employing around 40,000 souls, was the roaring engine of regional growth for decades. But from Audi’s parent overlord Volkswagen, no business tax cash has trickled into Upper Bavaria for a while now. Countless suppliers and service outfits clustered around have been hammered by economic woes. Unemployment is surging. The auto sector’s so-called “transformation” is smashing Ingolstadt “extra brutally,” Mayor Kern thundered.

“Ingolstadt isn’t some freak show outlier,” blasts Achim Sing, mouthpiece for the Bavarian Association of Cities. Almost every Bavarian municipality is choking on cash shortages, “even the ones that were fat and happy before.” Sing rattles off the casualties: Erlangen, Straubing, Regensburg. Even in the state capital Munich, they just announced another gut-wrenching drop in business taxes by 90 million euros a few days ago.

Tons of towns are wrestling to cobble together a balanced budget for next year and are piling on fresh debt like there’s no tomorrow. According to a damning finance report from the Bertelsmann Foundation, Bavaria’s municipalities racked up a record-shattering deficit of 5.3 billion euros in 2024.

Even the once-thriving Ingolstadt is now sucking down loans, but that’s got strict limits too. So, the city bosses led by Michael Kern are begging for a bailout from the state government: “We’re going to drag the Free State of Bavaria into this one-of-a-kind emergency and demand backup.”

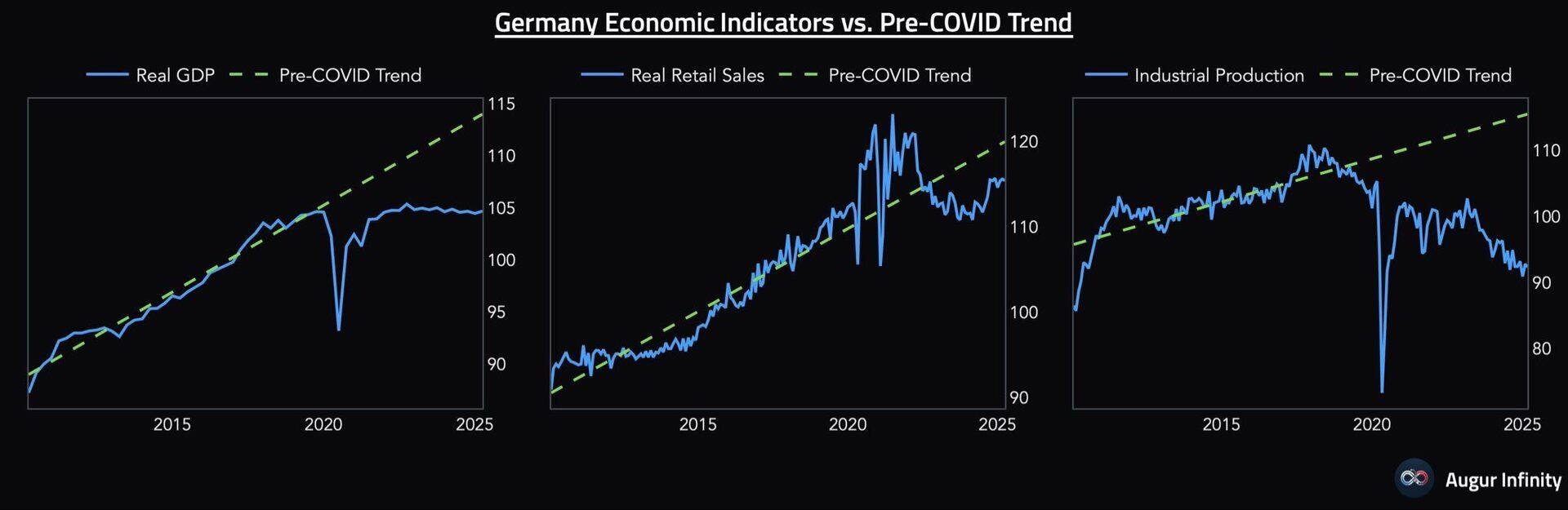

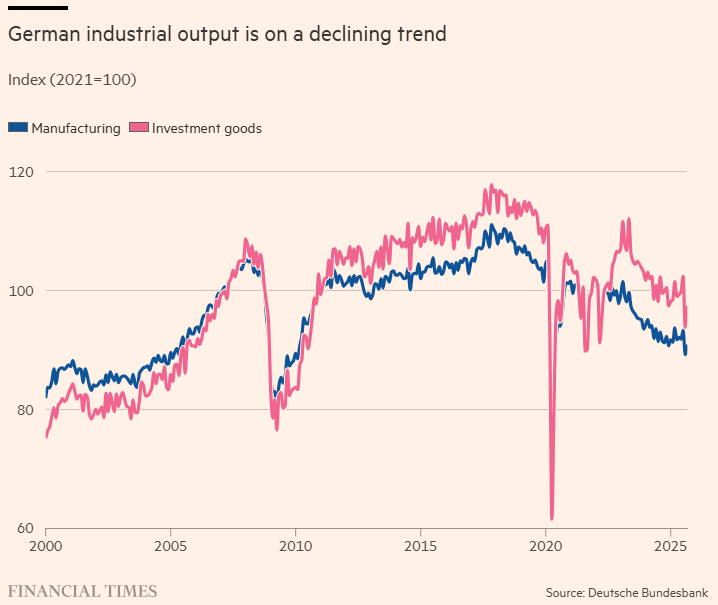

Allianz: In a fragmented, multipolar world, the country’s export-driven economy faces severe headwinds: rising tariffs, Chinese competition and persistently high energy costs. These pressures are reflected in a sharp decline in industrial production and weak gross value added (Figure 1). Domestically, structural challenges weigh heavily: demographic aging, labor market inefficiencies and mounting pressure on pensions and healthcare systems. Although the coalition government has recently advanced reform proposals, they will remain insufficient to reverse the growth slowdown in the short-term. Moreover, mounting economic pressures risk pushing the climate transition further down the political agenda. Growth is projected at just +0.1% in 2025, followed by only modest rebounds of +1.0% in 2026 and +1.4% in 2027, largely driven by the fiscal stimulus.

Germany: Bureaucracy compliance costs until beginning of October 2025

The current German government has had one of the worst starts among recent coalitions with over half of survey respondents disapproving of the performance.

Jobs massacre in Germany: On June 30, 5.42 million people were employed in German industry, 114,000 fewer than 12 months earlier. In the six weeks since, German corporations announced the elimination of more than 125,000 jobs.

Germany’s largest steel corporation, Thyssenkrupp, is cutting every second to third job, a total of 11,000. Deutsche Bahn (German Rail) plans to cut 30,000 jobs, and its subsidiary Cargo to cut 5,000. SAP is reducing its workforce in Germany by 3,500 and worldwide by 10,000. Deutsche Post is cutting 8,000 jobs and Commerzbank 3,900.

Auto manufacturers and their suppliers had already announced massive job cuts: VW, 35,000; Mercedes, 40,000; Ford, 2,900; Audi, 7,500; Daimler Truck, 5,000; ZF, 14,000; and Bosch, Continental and Schaeffler, a total of 7,000. Over 51,000 jobs have already been destroyed in the auto industry in the last 12 months.

German industrial production is only at its 2005 level, even after a partial rebound in September. Since the start of the year, Germany has run a deficit in capital goods with China, the first since 2008. Industrial production sits at the 2005 level even after a partial rebound in September. “Many of Germany’s economic core strengths have turned into vulnerabilities,” says Marcus Berret, global managing director at Roland Berger, a Munich-based consultant. Those include a large industrial base that is hard to decarbonise, a high dependence on exports at a time when globalisation is under threat, and a mighty auto industry having to write off 140 years of internal combustion engine expertise.

When you are asking: