(Last update Dec. 2025)

Read Part 1 for the story’s beginning: https://breakingnasdaq.beehiiv.com/p/wtf-happened-with-germany

Explore Part 2 to continue the story with the latest news and updates: https://breakingnasdaq.beehiiv.com/p/wtf-happened-with-germany-part-2

“I have experienced all of this once before”:

Nazis 2.0 are marching back into Germany and a 95-year-old survivor is ready to flee rather than relive the nightmare. Legendary actor Armin Mueller-Stahl, who endured Hitler’s regime and World War II, drops this bombshell: “The increasing antisemitism, the strengthening of the AfD - I have experienced all of this once before.” He calls Germany “not a friendly country” anymore, plotting emigration with his family to escape the rising tide of hate.

This is no isolated sentiment. The AfD’s far-right poison is fueling antisemitic attacks, echoing the 1930s playbook. If a man who’s seen the abyss is packing his bags, you should listen to him.

Sources:

For the first time since 2011, the yield on 10-year German government bonds has surpassed the dividend yield of the DAX Index. German investors are now seeing higher returns from government bonds than from holding shares in German firms - a telltale sign of extended economic stagnation, diminished faith in future growth and pessimistic outlooks for corporate earnings.

Germany just crossed a major red line on privacy. A new law passed in early December gives Berlin police sweeping surveillance powers: secret home entries to install state spyware, mass geodata collection, biometric scanning of social media, extended preventive detention, and the use of police data to train AI systems.

At its core, the amended ASOG equips Berlin’s security forces with a formidable toolkit for monitoring, transforming everyday devices and spaces into extensions of state oversight. The most alarming provision, detailed in paragraphs 26a and 26b, authorizes “source telecommunications surveillance” (Quellen-TKÜ) and covert online searches via state trojans - sophisticated spyware that intercepts encrypted communications before or after decryption. If remote installation proves technically infeasible, paragraph 26 permits undercover agents to physically and secretly enter suspects’ homes or premises to deploy the software, perhaps via a USB drive on a laptop or phone. This isn’t mere digital eavesdropping; it’s a license for burglary in the service of the state, applicable to investigations of serious crimes like terrorism or organized crime.

The law expands police capabilities to request massive geodata from telecom operators under paragraph 26e, enabling the creation of movement profiles for thousands in targeted areas through cell tower queries - a form of digital dragnet that ensnares innocents alongside suspects. Biometric tools take center stage in paragraph 28a, allowing automated matching of faces, voices, and other identifiers against publicly available internet data, including social networks, to identify individuals in investigations. Additional measures include bodycam deployment in private homes (paragraph 24c) when there’s a perceived threat to life, automatic license plate recognition (24d), drone countermeasures (24h), and even using police-collected data to train AI systems (42d) - a provision critics argue repurposes sensitive information far beyond its original intent. Preventive detention periods have also been extended to five days (or seven in terrorism cases), amplifying the state’s coercive reach.

The global competitiveness of some of Europe’s biggest economies, including the UK and Germany, hasn’t fully recovered from the crisis and lags the US and China, according to rankings from the International Institute for Management Development.

The energy crisis never ended in Europe: Germany’s chemical plants operated at just 70% capacity so far in 2025, the weakest level in 20 years. Years of elevated costs have hollowed out parts of Europe’s industrial core. Reliance on pricier LNG isn’t helping. Many companies found their cost-cutting efforts weren’t enough.

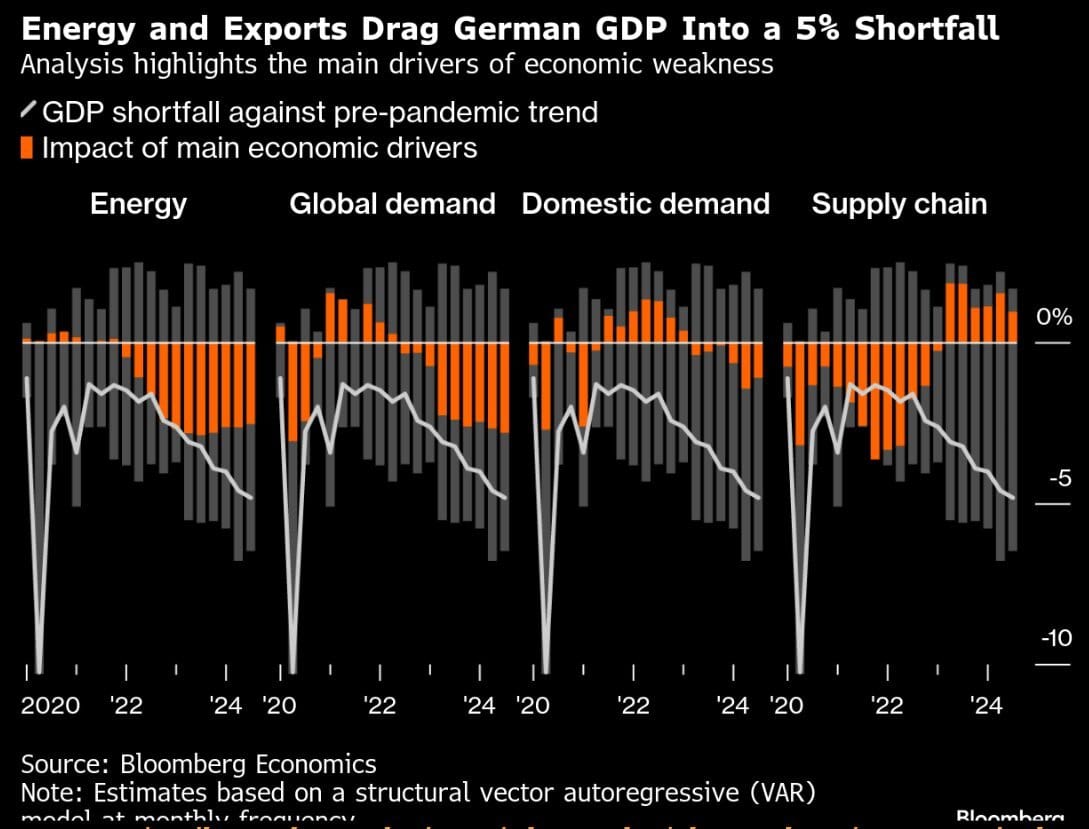

Germany's economy is unraveling: The economy is now 5% smaller than it would've been if the pre-COVID growth trend was maintained. Bloomberg Economics estimates that the shortfall will be tough to recover, due to structural blows like the loss of cheap Russian energy.

Germany’s electricity prices are twice as high as France’s:

Germany’s power mix: 33% wind, 14% solar, 40% fossil fuels

France’s power mix: 67% nuclear, 4% solar, 8% wind

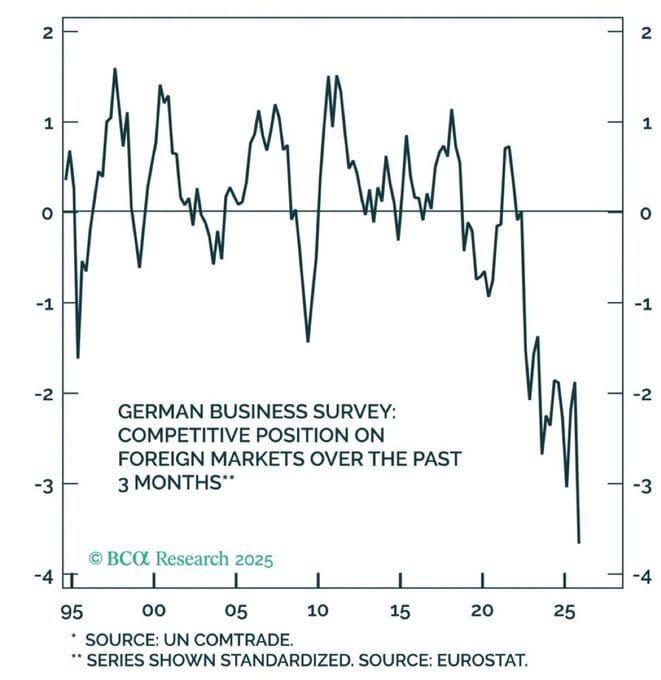

The chart tells a story that Germany’s political class prefers not to read. Germany’s competitive position on foreign markets has collapsed to levels not seen in decades, moving sharply into negative territory and staying there. This is not a cyclical wobble or a temporary demand shock. It is a structural breakdown in the export engine that defined the Federal Republic after 1945.

Germany rebuilt itself after WWII on three pillars: cheap and reliable energy, industrial depth and export competitiveness. The chart shows the last pillar giving way. When firms report sustained loss of competitiveness abroad, it means costs are structurally misaligned, investment is fleeing and production is no longer rational at home. That is exactly what we see: energy-intensive industry downsizing or relocating, capital expenditure postponed and supply chains quietly re-anchored outside Germany.

Blaming “global headwinds” misses the point. Every industrial economy faces the same global cycle, but not every economy chooses to self-impose energy scarcity, regulatory overload and policy-driven cost inflation at the same time. Germany did. The result is visible in the data. Climate policy here was not designed as an industrial transition but as an ideological acceleration, implemented faster than infrastructure, technology or capital formation could absorb. The price is paid in competitiveness, not press releases.

The historical parallel is uncomfortable but unavoidable. Germany’s postwar success came from pragmatism, not moral exhibitionism. Industrial policy was grounded in physics, engineering and export markets, not virtue signaling. When that balance is broken, decline is not gradual - it is abrupt. Export economies do not gently deindustrialize - they snap.