The U.S. stock market is going through a tough year, one of the worst in a long time. It’s falling behind global markets by about 10%, something we haven’t seen since the financial crisis. Still, people keep talking about a “recovery.” Don’t be fooled — it’s not looking as good as they say.

"For me, the message of this chart is this: If the percentage relationship falls to the 70%-80% area, buying stocks is likely to work very well for you. If the ratio approaches 200%, as it did in 1999 and part of 2000, you are playing with fire.”– Warren Buffett, Forbes, 2001

Source & more details: https://gqg.com/insights/playing-with-fire/

The Conference Board’s Leading Economic Index (LEI) has been on a steady decline, dropping in 38 of the past 41 months to its lowest point in 11 years. In July, it sent up another red flag, signaling a potential recession. Compared to the Coincident Economic Index (CEI), the LEI is now at its weakest since the GFC — a warning sign we can’t ignore:

Sales of Heavy Trucks are collapsing, which has usually foreshadowed an upcoming recession:

The United States is heading into a fiscal storm that runs deeper than any recession of recent decades. This is no longer about falling corporate profits or rising unemployment – it is about a structural imbalance that threatens to shake the very foundation of global markets. The mechanics are well known: as soon as the economy weakens, spending surges while revenues collapse. But this time, those automatic forces collide with a budget level already stretched to the breaking point. With annual deficits of four to six trillion dollars, we are no longer talking about “normal” crisis policy but about gaps approaching wartime financing – only without a war.

Historical parallels leave no doubt. During the dotcom bust, government spending surged by double digits while tax revenues fell by a quarter. In the 2008/09 financial crisis, the pattern intensified: deficits exploded, markets collapsed. Yet today’s starting point is far more dangerous. The U.S. carries a debt load of truly gigantic dimensions. At the same time, foreign creditor confidence is crumbling: China is cutting its holdings, Gulf states are experimenting with oil deals outside the dollar, and Japan is wrestling with its own fiscal burdens. That leaves the Federal Reserve under growing pressure to step in as the buyer of last resort – a scenario that risks tearing apart the balance between inflation, debt service, and market trust.

For investors, this is more than an abstract risk. It means that the long-assumed safety of U.S. Treasuries is eroding, that equity markets are caught in a trap between recessionary earnings declines and a central bank that can no longer serve as a reliable backstop. And it means that the dollar – for decades the unquestioned anchor of the global financial system – can no longer defend its exceptional status by default. Gold, commodities, and even digital assets are stepping out from the shadows of speculative niches to become serious alternatives in a world where faith in America’s “endless deficits without consequence” is vanishing.

This introduction is not doom-mongering but a sober conclusion drawn from numbers, historical patterns, and political realities. The article that follows shows in detail how a recession could turn into a fiscal supernova – and why investors should confront this scenario sooner rather than later.

Expensive markets. Tight spreads. Thin margin for error.

NVIDIA — an alternative angle:

The Crocodile Will Soon Snap: Markets are flashing textbook warning signs. Divergences are stacking up, valuations are stretched, and the crocodile’s jaws are wide open. History says they won’t stay that way for long — and investors must choose a side:

US payrolls revised down by 911,000 jobs — the largest cut in history:

U.S. Stock Market hits its most expensive valuation in history, surpassing the Dot Com Bubble and the run-up to the Great Depression:

The NASDAQ is now worth 176% of all the money in the US economy (M2) — way above the Dot-Com bubble peak of 135% — showing that tech stocks are rising much faster than the money supply and could already be in bubble territory:

Stop Worrying about Bear Markets — unless you’re not enough diversified:

Nasdaq relative to M2 Money Supply:

S&P 500 Price-to-Book valuation surpasses the peak of the Dot Com Bubble warns Bank of America:

Retail Investors have been loading up on stocks this year while professionals (a.k.a. the “smart money”) have been dumping:

Internet boom: ’98 rate cuts led to HUGE rally in stocks

AI boom: Fed is now cutting rates Stocks setting up for a late 1990s-style blow-off?

YTD, the US stock market has been disappointing, with the S&P 500 down 1% this year in EUR and up just 6% and 4% in JPY and GBP. In USD, it's up 13%, but that still means weak returns for investors outside the US.

The $SPX is now trading at 3.3x sales, its highest valuation in history.

The Schiller P/E has hit 40 for the second time in history since the dotcom bubble.

Michael Hartnett, BofA: How to trade a bubble

1. There have been 10 equity bubbles since 1900:

- The average trough-to-peak gains are 244%, ending with average trailing PE of 58x, and equity index trading 29% above 200dma

- Today, the Magnificent 7 is the best bubble proxy... it is up 223% since Mar'23 lows, and trades at a trailing PE of 39x, and is currently 20% above 200dma, i.e. more to go.

2. How to best position for the bubble:

- you go long the bubble, but beware - bubbles are short & very concentrated (the tech sector rose 61% in 6 months to 2000 bubble peak, while every other S&P 500 sector was down)

- barbell bubble with distressed value: asset bubbles boost economic growth, boosting cheap distressed value plays, e.g. only market that outperformed Nasdaq between Oct’98 & Mar’00 was Russia (distressed after debt crisis); so cheap, cyclical value today is Brazil (trading on 9x PE), UK (13x), and of course, global energy (PE = 13x);

- short corporate bonds of bubble stocks: that's because credit will price in balance sheet deterioration before stocks - tech corporate bond prices (CITE index) fell 13% between Oct’98 & Mar’00, while spreads widened from Jun'99 onward.

- short bonds: in 12 out 14 asset bubbles in past 300 years, bond yields rose as asset price inflation mutated into consumer price inflation eliciting a rise in policy rates to pop bubble (most recently JGB yields +230bps in final 12 months of 80’s bubble, UST +260bps in ’99, China yields up 150bps to pop ’07 bubble)

Since the financial crisis, US technology has dominated global investing. For fifteen years, skeptics warning of stretched valuations were repeatedly proven wrong. These companies combined visionary founders, monopoly-like positions, enviable margins, and massive growth, and they rode the era of zero interest rates to become the world’s largest firms. Capital, starved of alternatives, crowded into these “secular compounders,” and for more than a decade they outperformed everything else. The narrative became self-reinforcing: technology was not just a sector, it was the market.

But today, that trade has reached an inflection point. The boom now rests almost entirely on AI, and investors have turned it into a one-way bet. Fundamentals are flashing red: growth is slowing, competition is intensifying, and capital intensity is exploding to levels that recall some of the most catastrophic investment busts in history.

The parallels to the dotcom bubble are striking. In 2000, Microsoft and Cisco lost a third of their market value within a week, Amazon dropped nearly 80 percent in a single year, and the Nasdaq erased trillions in months. Strong companies didn’t protect investors from bad prices. Analysts at the time were slow to acknowledge reality – even late in 2000, Wall Street still forecast nearly 9 percent earnings growth for the following year. Investors holding “quality” at inflated multiples still faced a decade or more of dead money: Microsoft took fifteen years to regain its 2000 peak.

The same belief structure that powered the late 1990s is powering markets now. Then, American exceptionalism was the anchor: GDP grew 5 percent, deregulation juiced productivity, emerging markets collapsed, Europe and Japan stagnated, and the US was the sole engine of prosperity. Today, capital again pours into US equities under the “TINA” logic – there is no alternative. The second anchor was technological revolution. In 1999, IBM declared “The revolution has arrived.” Today, AI is framed in the same epochal language. The promise is not just new tools, but an economy transformed.

But the evidence shows the quality, valuation, and breadth of today’s bull market are not better than 2000 – in fact, they are worse.

Revenue growth at the tech giants has structurally decelerated. Microsoft, Alphabet, Amazon, and Meta already dominate their industries, capturing roughly 60 percent of sector profits. That concentration limits their ability to grow faster than the economy. Revenue growth, once 20–30 percent annually, is now trending toward single digits within five years – comparable to utilities and insurers, but with much greater cyclicality and risk.

Meanwhile, the supposed endless growth of digital advertising, which funds much of this investment, is fading. Advertising is already 70 percent digital, and its growth is expected to slow into the low single digits. Historically, total ad spend rarely exceeds 2 percent of GDP, meaning the pie has natural limits even if AI drives efficiency.

Competition, too, is nothing like the monopolies of the 2010s. Google no longer has the ad market to itself: ByteDance has overtaken Meta in global social media revenue, Amazon and Netflix are eating into the ad pie, and even Walmart and Uber are expanding aggressively. The cloud, once a three-player oligopoly of Amazon, Microsoft, and Google, now faces Oracle and other aggressive entrants. AWS margins have already compressed by seven percentage points. In China, datacenter overcapacity is so severe that utilization rates hover between 20 and 30 percent – eerily reminiscent of the fiber glut of the early 2000s.

That telecom glut is the most dangerous parallel. AT&T, Verizon, and WorldCom spent hundreds of billions laying fiber in the late 1990s, convinced by forecasts of exponential demand. Capital expenditures exploded, often to 60, 80, or even 100 percent of EBITDA, swallowing all cash flow. Debt piled up. When demand lagged, the sector imploded. WorldCom collapsed into bankruptcy, AT&T was forced into restructuring, and Verizon slashed dividends as its balance sheet buckled. Investors learned the hard way that building the infrastructure of the future can still destroy shareholder value if done at the wrong price and pace.

Today’s big tech firms are on the same trajectory, but at much greater scale. Microsoft, Alphabet, Amazon, Meta, and Nvidia are pouring unprecedented sums into AI datacenters, chips, and infrastructure. Combined CapEx for these five companies is projected to surpass $200 billion annually within two years. Microsoft and Alphabet are expected to spend more than 80 percent of EBITDA on CapEx, while Meta’s AI push already consumes around 120 percent of EBITDA. Even Apple, historically the most disciplined of the giants, is being pressured to join the arms race. Nvidia itself, the linchpin of the AI narrative, requires continual reinvestment as chip cycles shorten and each generation of GPUs rapidly cannibalizes the last. The more they build, the more they must replace. Depreciation charges are already soaring, and free cash flow margins are deteriorating across the sector.

This is not the profile of a “capital-light, cash-gushing” industry. It is the profile of an arms race, where enormous sums are spent in the hope that future monetization will arrive quickly enough to justify the investment. But just as with fiber in 2000, utilization is low, monetization is lagging, and the mismatch between spending and realized demand is widening. AI-related revenues are still under $20 billion globally, even as CapEx is projected to surpass $7 trillion by 2030. By comparison, internet revenues after the dotcom buildout reached hundreds of billions within a few years. Today’s gap between investment and realized income is even more extreme than the telecom bust.

Valuations only amplify the risk. The share of S&P 500 companies trading at more than ten times revenues is around 35 percent today, compared with 25 percent in 2000. Nvidia trades at more than thirty times revenues, while its market capitalization of $4.5 trillion represents about 15 percent of US GDP – three times the relative scale of Cisco at its 2000 peak. Cisco, then the essential infrastructure provider of the internet, collapsed when demand forecasts proved inflated. Nvidia now holds the same narrative role, but at a systemic scale.

The broader market is no safer. The S&P 500 trades at 23 times earnings, close to the 25 times of 2000, but with slower growth and fiscal deficits rather than a government surplus. In 1999, the US budget surplus was so large that Washington seriously considered ending Treasury issuance. Today, deficits are chronic and growing. Investors bullishly call this 1995 – the midpoint of the internet boom. But valuations, speculation, and fundamentals argue it is already 1999.

Even Microsoft illustrates the danger. In 2000, it traded at 60 times earnings while growing revenues at 35 percent. Today it trades at 35 times earnings with growth in the low teens. The multiple is lower, but the growth is far slower, leaving no margin of safety. And just as Microsoft delivered fifteen years of flat returns after 2000, investors today risk a lost decade even if businesses continue to grow.

Other bubbles show the same anatomy. The shale boom of the 2010s consumed enormous capital under the assumption of unending demand. When oil prices fell, overcapacity was revealed, margins collapsed, and investors were left with stranded assets and debt. The Nifty Fifty of the 1970s, the Japanese equity bubble of the 1980s, and the US railroads of the 19th century all looked like “this time is different” stories, with dominant companies at the center of revolutionary growth. Each ended with violent repricing once valuations, fundamentals, and capital spending collided.

The current AI mania combines the worst features of all of them. Like the dotcom era, valuations are detached from growth. Like telecom, CapEx is consuming EBITDA at unsustainable levels. Like shale, the buildout risks creating stranded assets. Like Japan, the concentration of wealth in a handful of names creates systemic fragility. And unlike all of them, today’s excesses are occurring in the world’s largest, most systemically critical firms – companies that dominate indices, ETFs, retirement accounts, and sovereign wealth portfolios worldwide.

The lesson is clear: essential does not mean investable at any price. AT&T’s networks were essential. Verizon’s lines carried the world’s traffic. Cisco’s routers powered the internet. WorldCom’s pipes were critical. All collapsed under the weight of overcapacity and mispriced expectations. The AI buildout, already consuming nearly all of big tech’s cash flow, risks replaying that story at a scale far larger than any bubble before it.

More insights:

“This entire market has been based on people not understanding that, imagining that scaling was going to solve all of this, because they don’t really understand the problem. I mean, it’s almost tragic.”

“Bigger fools. The nature of bubbles, however, is that no one can tell when they’ll pop. If the Nasdaq was overvalued in 2000, it was also overvalued in 1999 and 1998 and 1997. Investors rushed to buy stocks in the late 1990s so they would not miss out on the profits that their friends were making. The buyers, many of them overloading their portfolios with big-cap tech stocks, firmly believed they could sell to some greater fool who would always pay more than they did.”

Dejavu:

Shocking stat of the day: The top 10% largest US stocks now reflect a record 78% of market cap for the US stock market.

This exceeds the previous record set in the 1930s by 3 percentage points. This is also above the peak of the 2000 Dot-Com Bubble, when the percentage was 74%. By comparison, in the 1980s, the weight of the top 10% was below 50%.

Meanwhile, the top 10 stocks as a % of the S&P 500’s market cap is at a record 41%.

The market has never been so concentrated.

Institutional investors are net short US stocks (SPX & RUT) while retail investors are basically all-in with record-low cash levels. How is this going to end? What do you think?

“𝗪𝗵𝗮𝘁’𝘀 𝗪𝗿𝗼𝗻𝗴, Warren?”

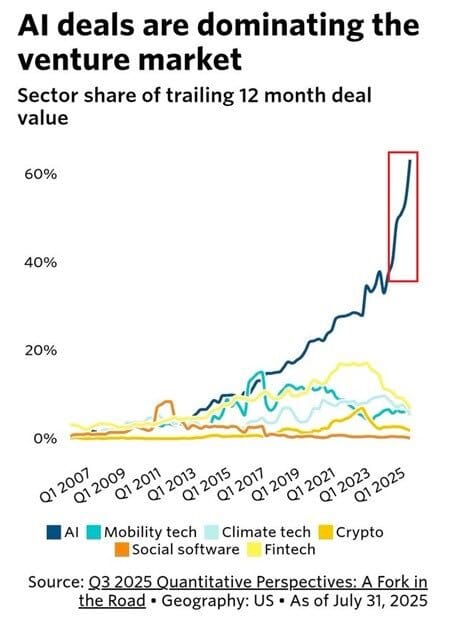

Over 60% of VC investment is now directed toward Artificial Intelligence (AI) ventures, notably surpassing the 40% allocation observed for internet companies at the peak of the 1999 bubble. Should these AI firms fail to achieve significant near-term revenue generation, a widespread withdrawal of investor capital is probable. This retraction could precipitate a rapid and extensive wave of corporate defaults among unprofitable entities, potentially triggering systemic market volatility reminiscent of the 2000 technology downturn.

Cass Freight index at pandemic lows:

"We are definitely not in a bubble" -> Deutsche: "The only time current CAPE ratios have been higher than current levels was during the build-up to the dot-com bubble in 2000"

We saw it with our own eyes using a telescope. I mean, for God’s sake, we took a fucking picture of it! What other proof do we need?

The % of Bears in the Investors Intelligence sentiment index moved down to 13.5% last week, which is below 98% of historical readings. It’s also lowest level we’ve seen since January 2018. What followed that? A -12% correction in the S&P 500.

Last week, Active Managers equity exposure jumped over 100% (leveraged long) with the S&P 500 at 6900. This was their highest equity exposure since July 2024. What happened back then? A -10% correction in the S&P 500.

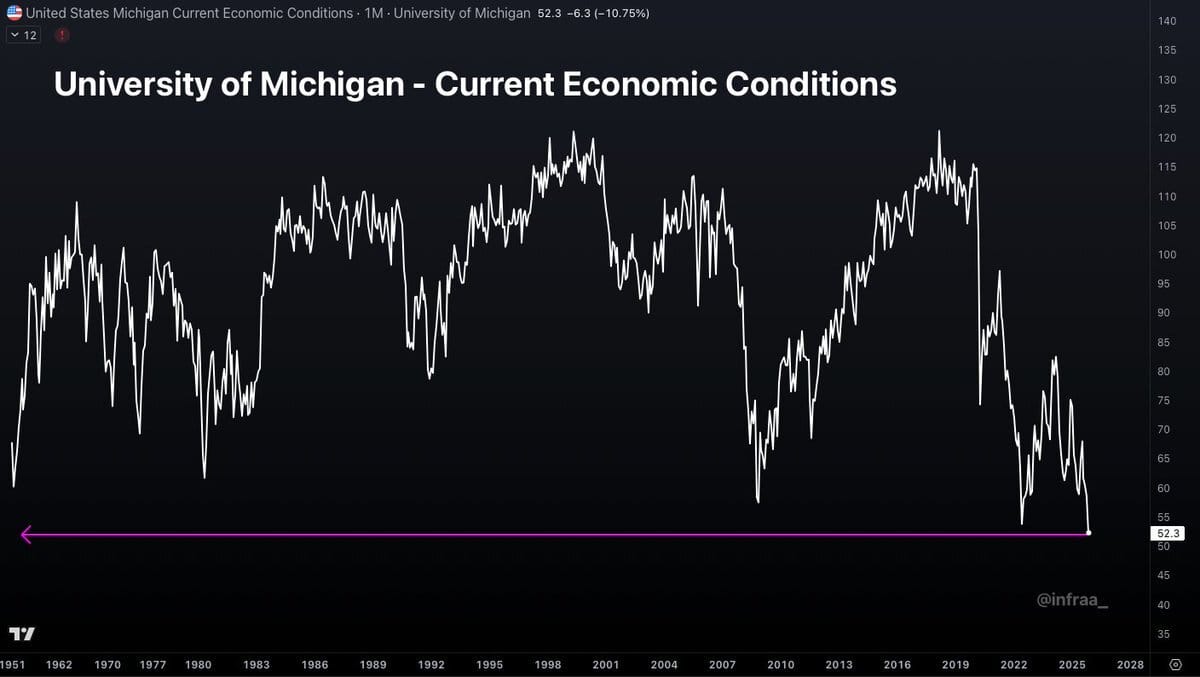

Current Economic Conditions plunged to the lowest level on record (74 years)