This is a summary which reflects my view on the current state of Germany and my expectations for 2025. The challenges we face are immense, and while there are pockets of resilience, the overall outlook demands urgent and innovative responses. Germany stands at a critical crossroads, and the decisions made now will shape not only its own future but also the trajectory of Europe as a whole.

Since 2019, Germany has experienced a significant decline in its industrial growth potential, losing approximately 20%. This downturn stems from a series of strategic missteps made in the 21st century, including overreliance on Russian energy, underfunding critical infrastructure, avoiding deficit-financed budgets, and underestimating China’s ability to leverage partnerships to boost its own manufacturing. Additional challenges include phasing out nuclear power, heavy dependence on export-driven growth, bureaucratic inefficiencies, lack of modernization, failure to address an aging population, and the strain on social systems caused by high levels of migration.

Why is Germany’s economy so important? As the economic powerhouse of Europe, Germany’s performance directly impacts the entire continent, including peripheral regions such as Russia and Ukraine. If Germany struggles, the ripple effects will be felt across Europe.

Job Cuts in German Companies Reach Alarming LevelsMajor German companies like Deutsche Bahn (30,000), ZF (14,000), and Continental (13,000) are planning significant workforce reductions. SAP (5,300) and Bosch (3,760) have also announced substantial layoffs. These examples are just the tip of the iceberg, as thousands of small and medium-sized enterprises are also downsizing—often without drawing much public attention.

Source: https://lnkd.in/dmdF8naJFull list of job cuts: https://lnkd.in/dGuqB87ahttps://www.linkedin.com/posts/activity-7267181337046904835-BouQ

Germany’s leadership is losing the public as the economy collapses into crisis. Over 40% of Germans now rank financial struggles as their top concern, dwarfing issues like Ukraine and climate change. Meanwhile, government-aligned media bombards viewers with narratives about global responsibility, climate goals, and solidarity with Ukraine, distracting from skyrocketing prices and declining wages. The disconnect between propaganda and reality is fueling public outrage, deepening distrust, and pushing the nation toward political and social upheaval.

Germany stands to lose the most from US tariffs, with a projected GDP drop that outpaces other major economies in the Eurozone, spotlighting its susceptibility to trade wars.

Source: GS, Link: https://lnkd.in/dnf2ydpKhttps://www.linkedin.com/posts/activity-7279195410433257473-y7Ne

Germany — is everything lost irrevocably?Since the 4th quarter of 2019, the US economy has grown by 11% in real terms, the Eurozone by 5%, while Germany's GDP has remained at the same level over the last five years.

Following 5 years of stagnation, Germany’s economy is now 5% smaller than it would have been if the pre-pandemic growth trend had been maintained. Germany is probably reaching a point of no return. Business leaders know it, the people in the country feel it, but politicians haven’t come up with answers.

Germany Is Unraveling Just When Europe Needs It Most.

Why get excited about Germany's increased NATO spending? It's like applauding for more fuel when the house is already on fire. We need to think bigger - like, how about investing in not having to fight at all? That's the kind of disruptive thinking we need. Peace is the real innovation we should invest in.

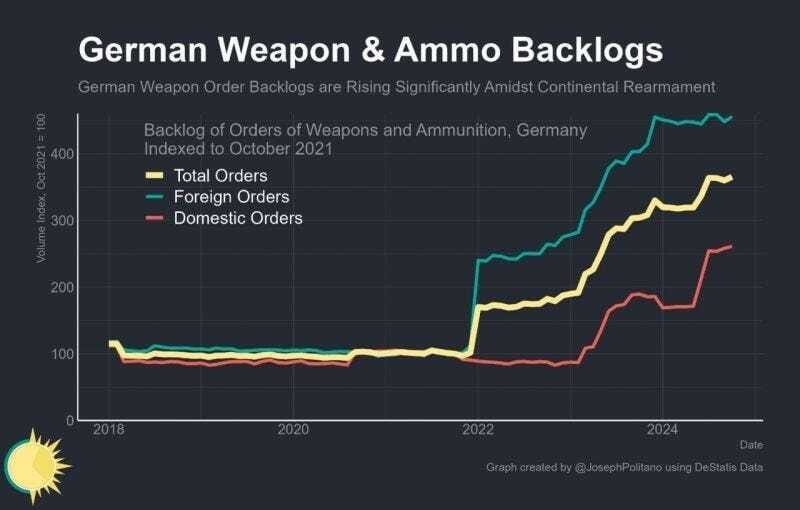

German industry is sinking into crisis—except for one sector: defense. Germany’s weapons and ammunition production is ramping up.

Source of chart: https://lnkd.in/dHKVZ92Jhttps://www.linkedin.com/posts/activity-7278042849214910466-2sO_

"We Are Facing a Systemic Collapse," Warns the German Chemical Industry Federation. This month, the price of one megawatt-hour in Germany reached €936 – a level of turmoil not seen even in 2022.

The crisis hasn't directly impacted citizens yet, as contracts are locked in a year in advance. However, even now, Germans are paying €400 per megawatt. In comparison, the average price in Russia is around €45 per megawatt.

Germany is preparing for potential long-term power outages as the share of renewable energy sources in the country drops to zero. Despite spending $1 trillion on energy modernization, the country is unable to provide a stable energy supply for its industry and is forced to import electricity, with prices spiking whenever the wind stops.

Sources: Oxford Economics, Bloomberg and https://lnkd.in/dTXBYXMKhttps://www.linkedin.com/posts/activity-7278475197240791040--fFs

🪫 🇳🇴 “It’s an absolutely sh*t situation”: Norway’s Energy Minister Reacts to the Country’s Electricity Prices

🇩🇪 🪫 🇸🇪 “Frustration with Germany”: Sweden Echoes Norway’s Concerns Over Rising Electricity Prices 🇩🇪

1. Norway

Norwegian Energy Minister Terje Aasland, quoted by the Financial Times, described the situation as “an absolutely sh*t situation.”

As a result, Norwegian authorities are considering abandoning the construction of a power transmission line to Denmark. Additionally, there have been calls to reassess electricity supply agreements with the UK and Germany. The reason behind these moves is the high cost of electricity, which could rise even further due to low wind activity in the North Sea, pushing prices to their highest levels since 2009.

In Norway, some critics argue that the country should only export electricity after ensuring low domestic prices. This stance has raised concerns within the EU.“

This is a turning point for EU-Norway relations. Reducing electricity supplies to Europe will not be received positively,” said an EU ambassador in Oslo.

The sharp increase in electricity prices during recent winters has caused political upheaval in Norway. Polls predict that right-of-center parties, who aim to reduce Norway’s exposure to European electricity prices by renegotiating agreements with certain European partners, may come to power in the next election.

2. Sweden

“Frustration with Germany”: Sweden Echoes Norway’s Concerns Over Rising Electricity Prices

Sweden joined in expressing similar concerns. Deputy Prime Minister and Energy Minister Ebba Busch criticized Germany’s decision to decommission its nuclear power plants, stating that this move has significantly contributed to soaring electricity prices in Sweden.

Southern Sweden is currently facing record-high electricity costs due to power being transmitted to Germany via underwater cables. Despite these challenges, Sweden is unable to halt electricity exports due to EU regulations.

Sources:https://lnkd.in/ezMxyBvrhttps://lnkd.in/eAv6tRrghttps://www.linkedin.com/posts/activity-7274896826074382336--dCg

Germany’s industrial growth began lagging behind the EU average as early as 2015, well before the challenges escalated in 2022. This indicates that the issue stems from systemic errors made over a decade ago.

Challenges Ahead for German Industry Amid Trump’s Return to Power

The Economist presents a sobering outlook for Germany’s industrial sector in light of Donald Trump’s return to the White House.

Since the onset of the Ukraine conflict, German businesses have been grappling with several significant challenges: surging energy costs, weakening demand from China, intensified global competition, labor unrest, and a government perceived as ineffective and soon to be replaced.

The stock performance of German companies reflects these difficulties, with shares rising only 2% since early 2022, compared to a 16% average increase across other advanced economies. Now, The Economist notes, German firms are increasingly concerned about the implications of Trump’s re-election.

As the United States is Germany’s largest export market, the stakes are substantial. In 2023, #Germany exported $160 billion worth of goods to the U.S. while importing $77 billion. Only #China, #Mexico, and #Vietnam enjoy a greater trade surplus with the U.S., placing German exporters at heightened risk under Trump’s protectionist policies.

Research from the Munich-based Ifo Institute indicates that German exports to the U.S. could decline by as much as 15% if Trump implements his proposed 10–20% tariff on all imports.

In response to these risks, German companies have ramped up their investments in the U.S. Over the past year, they announced nearly $16 billion in U.S.-based projects—almost double the prior year’s amount. These investments accounted for 15% of all foreign investments by German firms in 2023, up from 6% in 2022, reflecting a strategic shift to mitigate potential trade disruptions.

Germany Rules Out Nuclear Energy Revival

Germany’s leading energy companies, EON SE and RWE AG, have rejected proposals to restart decommissioned nuclear power plants, positioning the energy debate as a central issue ahead of February’s elections.

The nation’s last nuclear reactors were shut down in April 2023, following a policy decision made 12 years earlier by former Chancellor Angela Merkel in response to the Fukushima disaster. However, the opposition Christian Democratic Union (CDU) has recently questioned the move, particularly as Germany phases out coal and delays plans for new gas-fired power stations. In a policy paper released last week, the CDU called for a reassessment of nuclear energy’s role.

Executives from RWE and EON have stated that reopening the plants is “highly improbable” due to

1. regulatory barriers,

2. a shortage of skilled workers, and

3. concerns about the economic sustainability of nuclear energy.

RWE’s CEO further highlighted that nuclear power and renewable energy are not a strong match, as the increasing share of renewables diminishes the profitability of nuclear power plants.

It is commonly believed that the European Union began to lag behind America only with the start of the war in Ukraine in 2022. However, looking at the stock market of the two macroregions, we see that Europe's lagging began immediately after the financial crisis of 2008.

During the period from 2009 to 2023, the S&P 500 Index grew five times more compared to Euro Stoxx. The financial sector of Europe is hindering economic growth due to the inability to inject sufficient capital and liquidity into European companies. In simpler terms, Europe not only prints fewer money compared to the U.S. but also spends it "incorrectly" (from the perspective of America's economic principles) - on social welfare and pensions instead of injecting money into businesses.

The current challenges facing German industry are comparable to those seen during the Great Financial Crisis and the Covid-19 pandemic — and this is occurring during a period of relative economic stability. Many Germans remain unaware of the potential societal consequences a future recession could bring.

Germany’s economic decline is largely due to underinvestment in infrastructure, particularly in transport and energy sectors, which hampers growth and industrial competitiveness. The country faces energy challenges, with high reliance on outdated systems and the phase-out of nuclear energy, making it harder to keep up with modern industrial demands. These infrastructure shortfalls are critical in limiting Germany’s recovery, affecting not only its own economy but also the broader EU market.

Source of chart: StephaneDeo via Michel A.Arouet

German industry is becoming somewhat similar to Japanese, where rapid growth ended in the 1990s, with peak production in 2007, followed by a ~30% decrease to 1980s levels, including the impact of the Fukushima energy deficit and nuclear plant closures.Bloomberg: Germany’s Days as an Industrial Superpower Are Coming to an End. Reasons:- Competition with the USA: U.S. subsidies are increasing, and Germany is struggling to counteract this trend;- Competition with China, which is becoming less of a voracious importer of German goods;- Loss of cheap Russian energy, impacting energy-intensive sectors;All of this is happening against the backdrop of political "paralysis" in Germany, a labor shortage, and a deteriorating education system. Subsidies are gradually diminishing, and energy prices for industry have more than doubled, now among the highest in the EU and growing faster than in most countries.While the decline varies (some places closing production, others reducing volumes, and some relocating to other regions), recent production data indeed show a consistent trend of contraction -1.6% month-on-month and -3.0% year-on-year. On average, since 2023, the industry has contracted by 1.5%.In energy-intensive sectors, production declined by 5.8% month-on-month and 10.2% year-on-year in December, with a 22.5% decrease since December 2021. Although this sector is not critically large (around 17% of production), the concern lies in the persistently negative trends in the overall industry.

Tsunami of Antisemitism: "open and aggressively expressed antisemitism in all its forms" is "stronger in Germany than ever before since 1945."

Source: The Federal Government's Commissioner for Antisemitism, Felix Klein

Details: https://lnkd.in/dMTX4WJX

Democracy in German kind: Police Raid Pensioner's House, Drag Him To Court After He Retweets Meme Calling Green Minister "Idiot"

More details: https://lnkd.in/dX2RCs4Xhttps://www.linkedin.com/posts/activity-7263549852590985216-L4jx

The Euro Area’s global export market share has steadily declined since 2020, falling 4 percentage points below its 2015 average by 2024.

In 2025, the economies of the US and Europe will move in opposite directions. These are the forecasts from economists surveyed by Bloomberg.

China’s energy surge signals relentless economic expansion, while the EU’s decline hints at deindustrialization and stagnation. If trends hold, China’s dominance will reshape global markets, leaving the EU struggling to maintain relevance in a rapidly shifting economic order.

In the 1980s, the EU and US share of global GDP was about the same…

Study from Germany: Nearly half of the respondents believe that "true democracy" will only be possible "when capitalism no longer exists."

Only 42 percent of all citizens see their vision of democracy reflected in the political system practiced in Germany. This is one of the findings of the "Leipzig Authoritarianism Study 2024," titled United in Resentment, presented on November 13. The satisfaction rate with the functionality of democracy, a metric tracked since 2006, has reached an all-time low and, for the first time since 2010, has dropped below 50 percent. According to the study, many citizens are dissatisfied not only with the government but also with politicians and political parties. Politicians are most frequently accused of "greed, arrogance, and incompetence," as well as of "failing to represent the population's interests."

In eastern Germany, only 29.7 percent of citizens approve of "democracy as it functions in the Federal Republic of Germany." This figure had previously risen steadily from 27.2 percent in 2006 to a peak of 53.5 percent in 2022. However, the current drop of 23.8 percentage points marks an unprecedented decline.

According to the study, only 73 percent of the population considers democracy in Germany to be "legitimate." While 95 percent of respondents in eastern Germany support the "idea of democracy" in principle, the figure is slightly lower in the west at 89 percent. "People in eastern Germany seem to view the implementation of democracy, as defined in the Basic Law, as inferior," the study authors write.

Data shows that eastern Germans feel far more powerless in relation to politics than their western counterparts. A belief in political ineffectiveness is also more widespread in the east. Over 63 percent of the population nationwide considers political engagement futile, a sentiment unchanged since 2006. However, in 2018, only 56.1 percent of western Germans shared this view, compared to the current 61.7 percent. In eastern Germany, skepticism about political engagement has consistently been higher, with at least 65 percent expressing doubt. In the latest survey, this figure reached 71.8 percent.

Eastern Germans also report feeling increasingly powerless in the workplace. Only 28.8 percent believe they can "make positive changes" at work, down from 55 percent in 2020. Nearly half of respondents believe "true democracy" will only be possible "when capitalism no longer exists." Over 60 percent think globalization benefits "only powerful economic interests," which the study's authors interpret as a growing "anti-American sentiment."

Sources:https://lnkd.in/e9WajxFRhttps://lnkd.in/eCn5cfdAhttps://www.linkedin.com/posts/activity-7277612792730333184-qCub

Naturalization in Germany? Only Possible Through the Courts!

Germany has earned a notorious reputation: anyone wanting to become a citizen must either wait endlessly – or take their case to court. The waiting times for a German passport are astronomical. While government agencies continue to stretch processing times from 18 months to as much as four years, there’s now a “golden route” to citizenship: filing a lawsuit. A naturalization process without going to court? Nearly unthinkable!

In major cities, the number of lawsuits is skyrocketing, thanks to § 75 of the Administrative Court Procedure Act, which gives applicants a powerful tool: if the authorities don’t respond within three months, they can sue. Lawyers have seized on this as a business opportunity, now offering “naturalization by lawsuit” as part of their services. And who foots the bill? The state covers court costs, attorney’s fees, everything. Applicants save money and fast-track their citizenship “the lawsuit way,” while everyone else waits for the administration’s decision.

The Berlin administrative courts are already overwhelmed. Instead of a single chamber handling these cases, four judicial panels now tackle naturalization lawsuits. Over 1,500 lawsuits are pending in Berlin alone – and the numbers are only climbing. Courts in Munich and Hamburg are also on high alert. The message is clear: if you want to become a German citizen, you have to sue. Traditional applications? They’re just an obstacle course for the most patient.

The federal government wants to speed up naturalizations, and Berlin’s administration has set a target of 20,000 cases – twice the previous goal. But instead of accelerating processing, the state has opened the floodgates for lawsuits. Lawyers profit, applicants achieve their goal faster, and other cases get delayed. Courts are groaning under the pressure, yet the “fast-track naturalization” through litigation seems unstoppable.

The reality is blunt: in Germany, if you don’t sue, you’ll wait. A naturalization system that forces applicants to go to court is anything but sustainable – but it’s a windfall for the litigation business. Germany in 2024: the German passport, once a privilege, is now being traded like a fast-track service.

Source: NZZDetails: https://lnkd.in/dRwFwwFT

2025: What's next?

My memory is a little fuzzy, but #AfD rings a bell

Key Takeaways:

Germany, once the economic powerhouse of Europe, faces a profound economic and social crisis. Since 2019, its industrial growth potential has plummeted by 20%, driven by decades of policy missteps, including:

- Overreliance on Russian energy.

- Phasing out nuclear power without adequate alternatives.

- Insufficient investment in critical infrastructure and modernization.

- Heavy dependence on exports and underestimating China’s rise as a manufacturing competitor.

Compounding these challenges are demographic issues like an aging population, bureaucratic inefficiencies, and social strains from high migration levels.

Broader Impacts

Germany’s economic woes have significant ripple effects across Europe, particularly in peripheral regions like Russia and Ukraine. As Germany falters, the Eurozone risks prolonged stagnation.

Evidence of Decline

- Industrial Downturn: Major companies, including Deutsche Bahn, ZF, and Continental, are cutting thousands of jobs. Small and medium enterprises are quietly downsizing.

- Energy Crisis: Germany’s energy costs are soaring, with businesses and households paying exorbitant prices compared to other countries. Despite $1 trillion invested in renewable energy, the country relies heavily on imports and faces instability in supply.

- Social Unrest: Over 40% of Germans cite financial struggles as their primary concern, overshadowing issues like Ukraine and climate change. Public trust in political leadership is eroding, with dissatisfaction fueling systemic critiques.

Global Dynamics

Germany lags behind other advanced economies, including the U.S., which has grown by 11% in real terms since late 2019. Trade policies, particularly the prospect of U.S. tariffs under a returning Trump administration, further threaten Germany’s economic stability.

A Glimmer of Activity: Defense Sector

While most industries falter, Germany’s defense production is ramping up, highlighting a paradox in resource allocation amid broader economic decline.

The Outlook

Germany’s systemic issues—rooted in policy choices from over a decade ago—paint a grim picture. As the nation grapples with stagnation and industrial decline, its ability to recover and lead Europe appears increasingly uncertain. The rise of far-right extremism incl. AfD only deepens the urgency for bold and inclusive solutions.

Original posted on LinkedIn:

Updates:

Jan. 11, 2025: German industrial sentiment is near COVID lows…

Jan. 13, 2025: Tesla Overtakes Audi in Global Sales - EV maker delivers more vehicles than German premium brand

Update Jan. 13, 2025: Unemployment in the world's third-largest economy has risen for 24 months straight, the longest streak in at least 35 years. Germany has also likely experienced a 2nd straight year of contracting GDP, the longest stretch since 1999.